Striders Global Investment Pte Ltd (“SGI”), a wholly owned subsidiary of Striders Corporation (Securities Code 9816), a Tokyo Stock Exchange-listed company, announces that it has launched a new entity in Singapore, “Omusubi Capital VCC” (“OCV”), together with its strategic partners, VinaCapital and ACP Asset Management.

OCV was established in Singapore as an Umbrella Variable Capital Company with the aim of building a bridge between Japan and Asia, particularly South and Southeast Asia. Striders Group, whose corporate slogan is “Stride with the Challengers,” will serve as a gateway between Japan and Asia, and will serve as a platform to discover and invest in untapped growth areas and opportunities.

OCV’s fund manager is VinaCapital Pte Ltd (“VCG”), a wholly owned subsidiary of VinaCapital, a Vietnam-focused asset management company that manages a portfolio of approximately US$3.7 billion in assets. As the fund manager, VCG will share its fund management expertise with SGI, and will work together as a strategic partner in Vietnam and the Asia region.

OCV Structure and Overview

- Fund Manager:

VinaCapital Pte Ltd - Sub-Investment Advisor:

Striders ACP Asset Management Pty Ltd (Australia)

This is a joint venture between SGI and ACP Asset Management (ACP), an Australia- and Sri Lanka-based fund manager with approximately US$200 million under management.

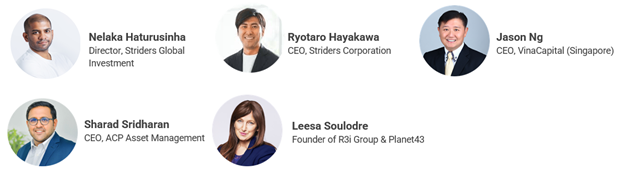

(3) Board composition:

Ryotaro Hayakawa (President & CEO of Striders Corporation)Nelaka Haturusinha (Director of SGI)

Jason Ng(VinaCapital Pte Ltd、CEO)

Sharad Shridaran(ACP Asset Management、CEO)

Leesa Soulodre(Managing General Partner of R3i & Planet43)

1st Fund: Omusubi Venture Fund

- Fund size: US$ 20 million

- Investment strategy:

Investing into AI and Deeptech oriented startups that provide solutions to fundamental social issues described as “deep issues” in Asia (especially in Japan, South Asia and Southeast Asia) in the following sectors: Smart city technology (climate and water related)

Agriculture

Healthcare - Uniqueness:

A high number of potential investment deals are sourced through our partner Acceleration Program, Planet43, in which participants are given a 12-week mentoring process on strategy development in commercialization, new market expansion, R&D, fundraising, and securing a successful exit. Investments are made in the top companies from each program.

Another feature of our fund is its cross-border market expansion strategy. Our fund strategically supports portfolio companies to expand into new markets (e.g. Japan ⇔ Europe/US, Europe/US ⇔ South/Southeast Asia, Japan ⇔ South/Southeast Asia).

Future investment strategy for the 2nd fund

While the first fund focuses on investments in Asian startups, the second fund plans to invest within Japan, which has seen strong demand from foreign investors.

• Real estate properties in the hospitality sector, such as residences and hotels in Japan

• M&A deals for companies related to business succession in traditional Japanese industries

About “Omusubi Capital VCC.”

Omusubi Capital VCC is an Umbrella Variable Capital Company (UVCC) in Singapore. The meaning behind the naming of “Omusubi” is that Striders will be the gateway connecting (“musubi – 結び”) strategic stakeholders to create a better and a more sustainable world. The happiness or the wellbeing resulted from a sustainable world is represented by food (おむすび, Omusubi or the rice ball). The triangular shape of the logo represents the share of a rice ball (omusubi) and inside the triangular shape represents “ume musubi” (ume knot).